Every few years, usually when trust in government hits a new low, an old argument roars back to life:

- Paying taxes is voluntary.

- The Constitution doesn’t require it.

- The tax code isn’t compulsory law.

This time, the call isn’t just coming from the libertarian corners of the internet. It’s showing up in liberal spaces, too, framed as protest, as resistance, and as a refusal to bankroll policies and leadership people find immoral or dangerous.

The anger behind this moment is real. The argument behind it is not.

And confusing the two can hurt people who are already stretched thin.

Why This Argument Keeps Coming Back

When people feel unheard, overworked, and politically sidelined, they start looking for pressure points. Taxes feel like one of the last levers ordinary people can pull.

Libertarian movements have long framed taxation as coercion. More recently, some progressives have framed nonpayment as a form of complicity refusal. Different politics. Same pressure valve.

The appeal is obvious. If paying taxes is optional, refusing to pay becomes a powerful moral stand rather than a personal risk.

But that premise is FALSE.

The Dangerous Half-Truth: “Voluntary Compliance”

You’ll often see this phrase cited as proof that income tax isn’t mandatory.

It’s true that the U.S. tax system relies on self-reporting. You calculate what you owe, file the forms, and send the payment.

That’s where “voluntary” ends.

The obligation to file and pay is established by federal law and has repeatedly been upheld by the courts. Judges no longer debate this point. They dismiss arguments to the contrary as frivolous and move on to penalties.

What gets lost online is that voluntary compliance describes the process, not the choice.

The Constitutional Claim That Won’t Die

Another version of this argument holds that the Constitution never authorized an income tax, or that the authorization was invalid.

That debate ended in 1913. Last I checked, an amendment to the Constitution is the Constitution.

The Sixteenth Amendment explicitly granted Congress the power to tax income. It has been enforced continuously for more than a century. Courts at every level have rejected claims that it doesn’t apply to individuals, wages, or private citizens.

These aren’t open questions. They’re settled law.

That matters because people repeating these claims online rarely mention what happens next.

Protest vs. Civil Disobedience

There is a long, honorable tradition of refusing to obey unjust laws. Thoreau did it. Civil rights leaders did it. Labor organizers did it.

But there’s an important distinction that often gets erased online:

Civil disobedience does not mean consequence-free disobedience.

Historically, tax resistance worked because people accepted the penalties and used them to expose injustice. They planned for the fallout and understood the stakes.

What we’re seeing now is something else. A flood of social media posts suggests people can opt out of paying taxes without legal risk. That isn’t a protest. It’s misinformation with a body count measured in liens, garnishments, and court dates. If you’re going to resist, you deserve to know what you’re actually risking.

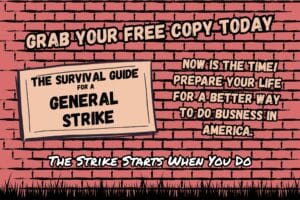

Why This Matters to a General Strike

A general strike isn’t about individual acts of desperation. It’s about coordinated, sustainable pressure that doesn’t collapse the people it’s meant to empower.

Unplanned tax resistance doesn’t weaken an administration. It weakens individuals, especially those without lawyers, savings, or institutional protection.

Burnout is a strategy used against movements. So is encouraging people to take legal risks without adequate preparation.

That’s why knowing your rights matters. And why understanding the line between protest and exposure matters even more.

If you’re looking for grounded, practical information on what protesters can and cannot legally do, we maintain a growing resource library at GeneralStrike.net/know-your-rights. It’s designed for exactly this moment.

There Are Legal Ways to Apply Pressure

This isn’t a call to compliance for its own sake. It’s a call to be strategic.

History shows that movements win when they:

- Organize collectively instead of acting alone

- Choose pressure points that scale

- Protect participants from unnecessary harm

- Pace themselves for the long haul

There are lawful ways to protest an administration. Lawful ways to withdraw consent. Lawful ways to disrupt business as usual without handing the state an easy win.

The Bottom Line

The claim that paying taxes is optional under U.S. law is not true. It hasn’t been true for generations.

What is true is that people are angry, exhausted, and searching for leverage. That instinct isn’t wrong, but acting on bad information helps no one.

A movement that survives is a movement that plans.

A movement that wins is one that understands the rules well enough to bend them without breaking its people.

If you’re ready to resist, do it with your eyes open.

If you’re ready to organize, do it together.

And if you’re ready to learn, we’ve built tools for that too.

Dancing Quail